Hey there, fellow developers! Ever felt the pressure of making sure an online store's payment system is not just functional but also iron-clad secure? You're not alone. In today's digital world, a smooth and secure checkout experience is the backbone of any successful e-commerce business. And at the heart of that experience lies something crucial: Payment API integration

This isn't just a technical task; it's about building trust with your customers. A glitchy or insecure payment process can spell disaster, leading to lost sales and a tarnished reputation. That's why understanding how to integrate payment gateway effectively is more important than ever. We're going to break down everything you need to know, from the fundamentals to the most advanced payment API best practices, so you can confidently build robust, secure, and user-friendly payment systems.

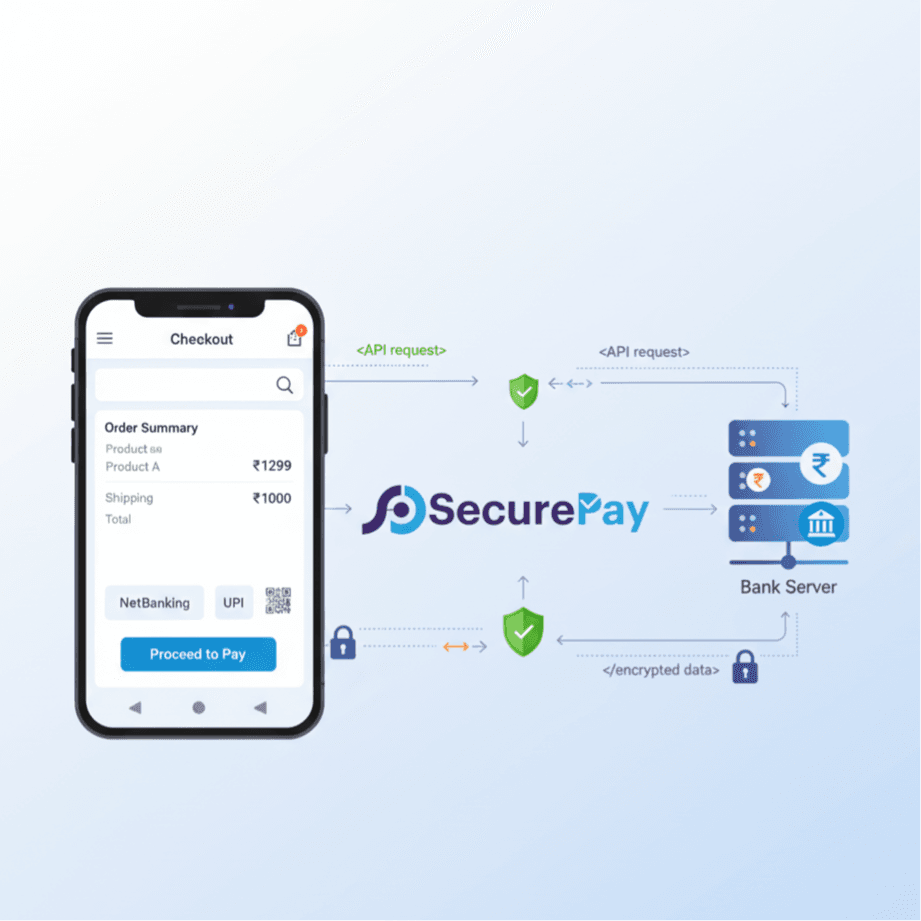

At its core, a payment API integration is the process of connecting your application or website to a third-party payment gateway. Think of it as a digital bridge that allows your customers to securely send their payment information to a payment processor. This API, or Application Programming Interface, is a set of rules and protocols that lets different software applications "talk" to each other. When a customer hits "Pay Now," the API takes over. It securely captures the card details, encrypts them, and sends them to the payment gateway. The gateway then communicates with the banks and card networks to verify the funds and approve the transaction. Once approved, the API sends a confirmation back to your application, completing the purchase. This entire process happens in a matter of seconds, creating a seamless user experience.

Selecting the right payment gateway for developers is the first and most critical step. The market is full of options, each with its own set of features, fees, and documentation. You need to consider factors like transaction fees, supported currencies, and, most importantly, the quality of their developer tools and support. Some gateways, like Stripe and Braintree, are known for their developer-friendly APIs and extensive documentation. They offer a wide range of tools, including pre-built UI components and SDKs, which can significantly speed up your development process. For instance, Stripe's Elements library lets you create secure payment forms without having to handle sensitive card data on your servers, which is a major win for security.

Security isn't an afterthought; it's a foundational pillar of any payment API integration. Ignoring security can lead to data breaches, massive fines, and a complete loss of customer trust. To avoid these pitfalls, you must adhere to industry-standard security protocols. A key best practice is to always use HTTPS for all communication between your application and the payment gateway. This ensures that all data is encrypted during transit, protecting it from interception. Furthermore, you should never, ever store sensitive payment information like credit card numbers on your servers. Instead, use a payment gateway's tokenization service. This replaces the card number with a unique, non-sensitive token that can be safely stored and used for future transactions. Payment APIs: What Are They and How Do They Work? Payment API explained: Connecting a payment gateway

Shopify, a leader in e-commerce, built its platform on a foundation of seamless payment API integration. By offering merchants a choice of over 100 payment gateways, including their own Shopify Payments, they made it incredibly easy for businesses to start selling online. The platform handles all the complexities of PCI compliance, tokenization, and fraud detection behind the scenes. This allows developers to focus on building great storefronts and applications rather than worrying about the intricacies of payment processing. The result? A user-friendly ecosystem that has powered millions of businesses worldwide.

When Uber disrupted the taxi industry, their seamless, in-app payment experience was a key differentiator. They integrated payment gateways like Braintree to handle millions of transactions securely. Uber's developers didn't have to build a payment system from scratch; they leveraged a powerful API to manage everything from credit card storage to split payments and promotions. This allowed them to scale rapidly and provide a frictionless experience where users never had to worry about handling cash. This is a perfect example of how to integrate payment gateway in a way that enhances the core user experience.

Starbucks’ mobile app is a masterclass in how to integrate payment systems to drive customer loyalty. By integrating their app with a payment gateway, they enabled customers to pay for their coffee with a quick scan of their phone. This not only sped up the checkout process but also allowed them to offer a rewards program directly tied to the payment system. The payment API integration was crucial to this strategy, as it securely linked the customer’s payment method to their loyalty account, personalizing the experience and boosting sales.

As technology evolves, so does the world of payments. We're seeing a rise in mobile wallets, cryptocurrencies, and even "buy now, pay later" services. To stay ahead of the curve, developers must continue to embrace new technologies and adapt their payment systems.

SecurePay.

Payment Gateway page.

The future of payment API integration is centered around security, speed, and a frictionless user experience. Platforms that can offer one-click checkouts, personalized payment options, and robust fraud detection will have a significant competitive advantage. The work you do now, building secure and reliable payment gateway for developers, is laying the groundwork for the next generation of e-commerce. Remember, a successful payment API integration is more than just code. It's a combination of smart technology, meticulous security, and a deep understanding of the user journey. By following these best practices, you're not just building a payment system; you're building trust, one transaction at a time.